how to find net income from balance sheet

How are the iii Financial Statements Linked?

The 3 financial statements are all linked and dependent on each other. In financial modeling , your starting time job is to link all three statements together in Excel, so information technology'due south critical to understand how they're connected. This is also a common question for investment cyberbanking interviews, FP&A interviews, and equity research interviews. See CFI'southward gratis interview guides to larn more.

In this tutorial, we will break information technology downward for you footstep-by-pace, although we assume you already accept a basic understanding of accounting fundamentals and know how to read fiscal statements.

Want to see a live demonstration?Lookout CFI'south free webinar on how to link the 3 financial statements in Excel .

Bookkeeping Principles

The income statement is non prepared on a cash basis – that means accounting principles such as revenue recognition, matching, and accruals can make the income statement very unlike from the cash flow argument of the business. If a company prepared its income statement entirely on a cash basis (i.east., no accounts receivable, nothing capitalized, etc.) it would accept no balance sail other than shareholders' equity and cash.

It'southward the creation of the balance sail through accounting principles that leads to the rise of the cash flow statement.

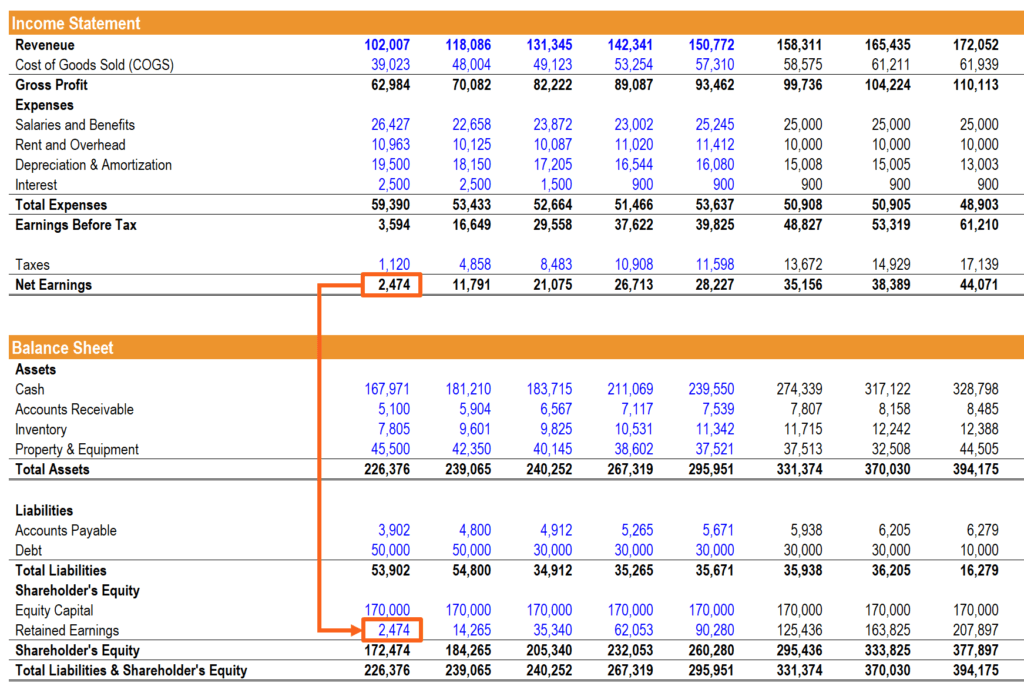

Net Income & Retained Earnings

Internet income from the bottom of the income statement links to the balance sheet and cash catamenia statement. On the balance sheet, it feeds into retained earnings and on the cash period statement, information technology is the starting indicate for the cash from operations section.

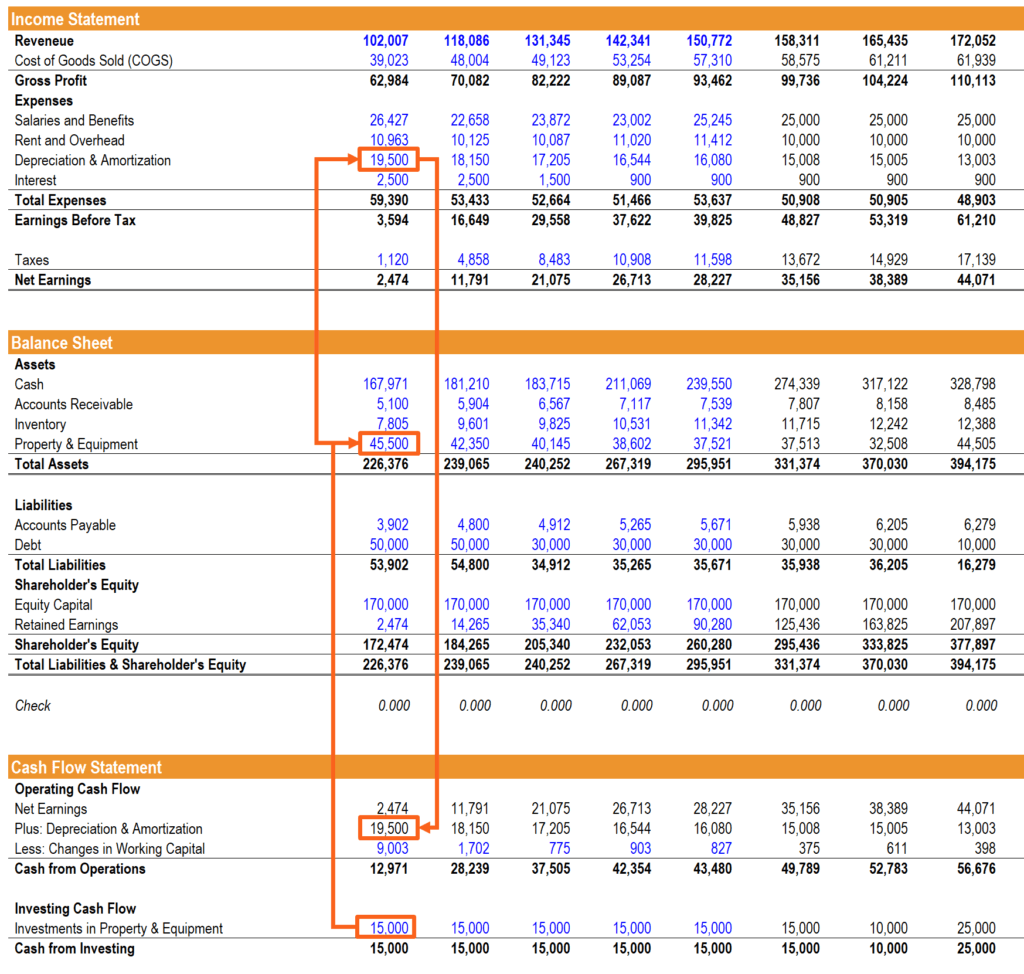

PP&Due east, Depreciation, and Capex

Depreciation and other capitalized expenses on the income statement need to be added back to net income to calculate the greenbacks period from operations. Depreciation flows out of the balance sheet from Property Constitute and Equipment (PP&East) onto the income argument as an expense, and so gets added back in the cash menses argument.

For this section of linking the 3 fiscal statements, information technology's important to build a dissever depreciation schedule .

Capital expenditures add to the PP&Eastward account on the rest sail and flow through cash from investing on the cash flow argument.

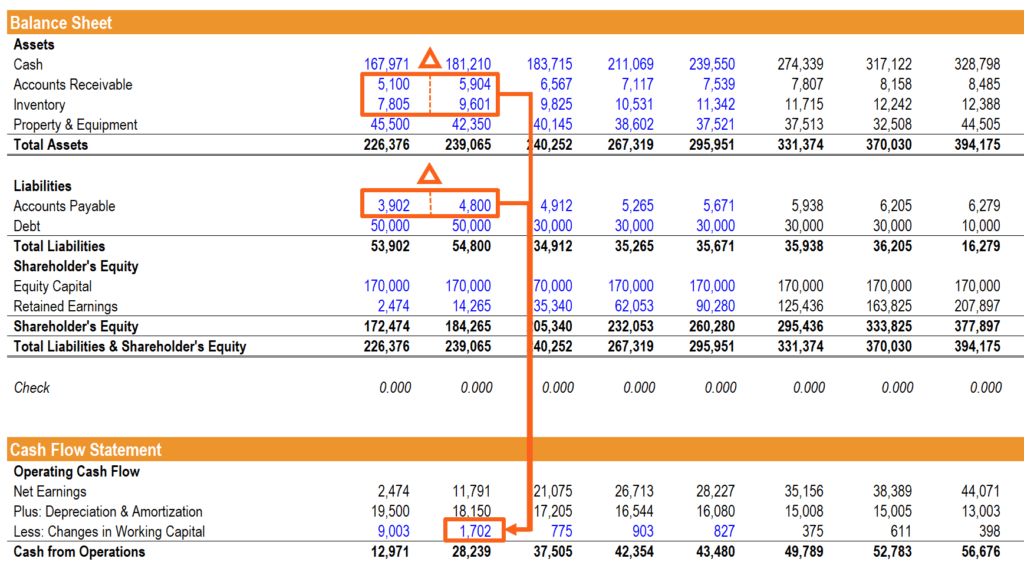

Working Capital

Modeling net working uppercase can sometimes be disruptive. Changes in current assets and current liabilities on the balance sheet are related to revenues and expenses on the income statement but need to exist adjusted on the cash menstruation statement to reflect the actual amount of cash received or spent by the business organisation. In club to do this, nosotros create a separate section that calculates the changes in cyberspace working capital.

Financing

This tin can be a tricky part of linking the 3 statements and requires some additional schedules. Financing events such equally issuing debt bear on all 3 statements in the following way: the involvement expense appears on the income statement, the principal amount of debt owed sits on the balance sheet, and the change in the principal amount owed is reflected on the cash from financing department of the cash catamenia statement.

In this section, it's often necessary to model a debt schedule to build in the necessary detail that'southward required.

Cash Residual

This is the concluding stride in linking the 3 fiscal statements. Once all of the above items are linked up properly, the sum of cash from operations, cash from investing, and cash from financing are added to the prior period endmost cash residuum, and the result becomes the electric current menstruation closing cash remainder on the remainder sail.

This is the moment of truth when you discover whether or non your residue canvas balances!

How to Answer the Question in an Interview

If you get an interview question along the lines of, "How are the iii financial statements linked together?" in an interview you shouldn't become into as much detail as to a higher place, but instead simply hit the main points, which are:

- Internet income from the income statement flows to the residual canvas and greenbacks flow statement

- Depreciation is added back and CapEx is deducted on the greenbacks flow statement, which determines PP&E on the remainder sheet

- Financing activities by and large bear upon the residue sail and cash from finalizing, except for interest, which is shown on the income argument

- The sum of the final period's closing cash residue plus this periods cash from operations, investing, and financing is the closing cash balance on the balance sail

If you desire to see a video-based example, watch CFI'swebinar on linking the 3 statements .

How to Link the Financial Statements for Financial Modeling

If you lot're building a financial model in Excel information technology's critical to exist able to quickly link the iii statements. In social club to do this, there are a few basic steps to follow:

- Enter at least 3 years of historical financial information for the 3 financial statements.

- Calculate the drivers/ratios of the business for the historical period.

- Enter assumptions nigh what the drivers will be in the future.

- Build and link the financial statements post-obit the principles discussed in a higher place.

The model essentially inverts, where the historical period is hardcoded for the statements and calculations for the drivers, and then the forecast is hardcodes for the drivers and calculations for the financial statements.

Check out CFI's step-by-step courses to learn how to build financial models in Excel .

Video of Linking the 3 Statements

Scout CFI's live video demonstration of linking the statements together in Excel.

More than Financial Resources

We hope this has been a helpful guide on How the 3 Financial Statements are Linked Together. To keep learning more than, please check out these relevant CFI resources:

- Gratuitous Cash Flow

- EBITDA

- Debt Schedule

- Complete Financial Modeling Guide

- 3 Statement Model

- DCF Model Guide

- Types of Financial Models

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/3-financial-statements-linked/

Posted by: ferrantelittly.blogspot.com

0 Response to "how to find net income from balance sheet"

Post a Comment